Ag tells senators don't tax inputs

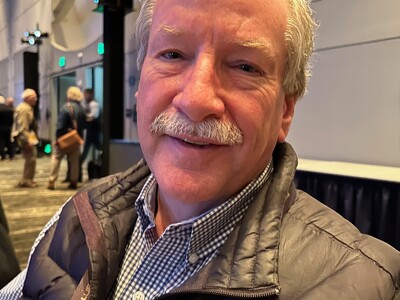

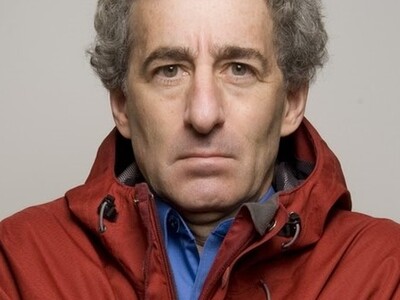

Washington Ag Today May 9, 2011 There may not be the votes for them to go anywhere, but the Senate Ways and Means Committee held a public hearing last week on several bills proposed by a group of Senate Democrats that would reduce or eliminate some tax preferences and exemptions, including some for agriculture. Among those testifying against the bills was Scott Dilly of the Washington State Farm Bureau. Dilly: “Specifically on 5945 we are concerned about the tax increase of food processors and on stevedoring. We believe they would negatively impact the export market that we have. And on 5947 that bill would definitely harm the beef, dairy and poultry industries with regard to bull semen, propane and chicken bedding. Those are input costs and in other industries input costs are not taxed. We feel that those input costs for agriculture should also not be taxed. So we believe that the tax exemption that is there should stand. And I would encourage you not to pass this bill. Again, any tax increases will only prolong the agony for Washington farmers. What we want to do is protect the industry and help it to grow so we have a good vibrant rural economy and a good export market. Representatives from the cattle, fruit, poultry, potato and hort industries also testified. Some of them said the estimate of the revenue to be generated by eliminating the tax exemptions was vastly overstated. I’m Bob Hoff and that’s Washington Ag Today on Northwest Aginfo Net. ?