State initiatives seek to end tax exemptions

Washington Ag Today April 29, 2011 Agricultural interests continue to monitor proposals to address the state’s budget deficit both in the statehouse and outside it. The legislature began a 30-day special session this week in which lawmakers are trying to resolve differences in budget proposals between the House and the Senate.

The Washington State Potato Commission says that in the special session agriculture is concerned that remedies for the budget could put a disproportionate share of the burden on farming. An example are proposals to offset cuts to the Washington State Department of Agriculture by increasing current fees as well as instituting additional costs.

In the first of what is expected to be a summer long effort, supporters of raising revenue by ending tax exemptions have filed two initiatives with the Secretary of State’s office that propose closing tax “loopholes” to help pay for education and social services. The initiatives are a way to overcome the constraints of Initiative 1053, which voters passed last fall and which has made it nearly impossible for the legislature to increase taxes. A two-thirds majority vote is needed to raise taxes. Some lawmakers question whether removing an exemption for an existing tax qualifies as raising taxes.

Exemptions from a number of taxes such as farm fuel and the B&O tax help keep Washington farms in business. The Washington State Potato Commission says it is also watching what any funding reductions to Washington State University would do to on-going agricultural research.

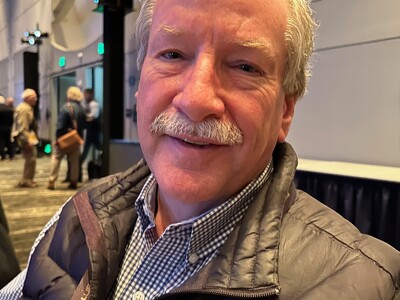

That’s Washington Ag Today. Brought to you in part by the Washington State Potato Commission. Nutrition today. Good health tomorrow. I’m Bob Hoff on Northwest Aginfo Net.