Climate Commitment Carbon Tax Pt 2

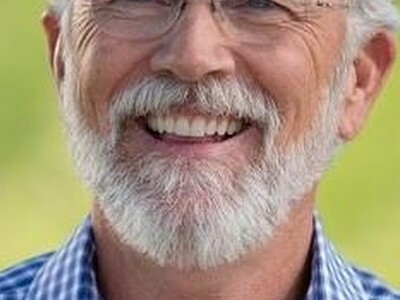

From the Ag Information Network, I’m Bob Larson with today’s Fruit Grower Report. We’re now going on six months that ag producers are being charged a carbon tax they are supposed to be exempt from.Washington State Tree Fruit Association president, Jon DeVaney says the law was enacted without a mechanism in place for the tax exemption …

DeVANEY … “There are a couple of fuel suppliers who have figured out a way to offer that, but there are others who are saying that without further guidance from the legislature or Department of Ecology that there not going to be able to do that.”

Unfortunately, DeVaney says a legislative fix was not found in time …

DeVANEY … “We were hoping that the legislature might clarify that situation, but there was not agreement on a package of legislation that we could accept that would actually make the situation better before the session ended.”

And now with some legislative downtime …

DeVANEY … “So now we’re pivoting to having conversations with Ecology at a fairly high level on how they can get some clarity to those fuel suppliers so that agricultural producers can be exempt as the law currently tells them they should be.”

DeVaney says finding a tax fix is a big deal for many …

DeVANEY … “That’s a very high priority item, I think, and we keep making the point to the Department and to the legislature that agriculture, especially smaller producers, are not in the position of being able to float this additional cost for a year or two while they figure this out.”

DeVaney says they need to get it sorted out quickly because these can be some very high dollar amounts.