Field burning equipment tax exemption to expire; Stockland Livestock report

Washington Ag Today November 16, 2010 A sales and use tax exemption for purchases of certain equipment to reduce field burning will expire January 1st of 2011. The Department of Revenue says in order to qualify for the exemption before it expires, delivery of equipment must take place before January 1st. Qualified farmers have been able to purchase equipment to reduce field burning since 2000 but a 2005 legislative update to the tax exemption included a five-year sunset provision. The Legislature had enacted the exemption to encourage alternatives to field burning of cereal grains and turf grass grown for seed. In 2009 the Joint Legislative Audit and Review Committee concluded that the “transition to reduced air emissions from agricultural burning has occurred.” and recommended that the exemption be allowed to expire. More information on the exemption, including which counties and equipment qualify, is available at a new Department of Revenue web page for farmers. .

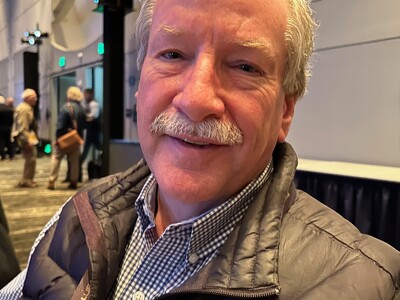

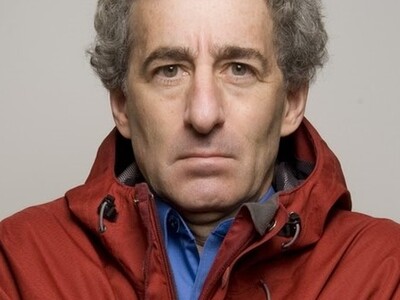

Now the report from Stockland Livestock. “This is Jack McQuiness with Stockland Livestock up here in Davenport. Two-thousand head of cattle on the market here on Monday. We had a big run of cattle. Lots of good quality feeder cattle. Call that market fully steady. Cows and bulls a couple of dollars higher here. Best of the cows bringing up against 57 to 58 cents with the bulk in the high 40s and low 50s. Steers topped at $1.31 for some real nice weaned calves on steers weighing 540 pounds. Strong sale on the way around. That’s Stockland Livestock here in Davenport. Thanks for listening. Thanks Jack. I’m Bob Hoff and that’s Washington Ag Today on Northwest Aginfo Net. ? ?