New Proposal Could Tax "Unrealized Gains"

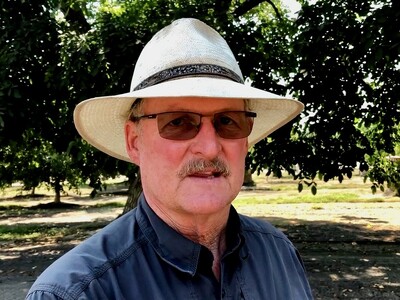

With your Southeast Regional Ag News, I am Haylie Shipp. This is the Ag Information Network.A proposal in Washington, D.C., could make it harder for family farms to stay in business according to one Senator. The proposal would put a new tax on “unrealized gains,” requiring farm owners to pay taxes on yearly increases in the value of their operations. Former Nebraska Senator Ben Nelson says the proposal shows a lack of understanding about issues in rural America…

“Back in D.C., there is no real understanding of rural America and family farms and small businesses like those of us who live out here have it. So, they think that because they can come up with an idea, they can make it happen, and that's probably true because they have the authority, but it doesn't mean that it will make sense.”

He says it doesn’t make any sense to tax farmers on income that hasn’t been earned…

“If you think about a family farm with a lot of acres and a lot of equipment and tools, that property - both the land and the equipment - has value, there's no question about it. But it’s not in cash form, so to pay a new tax every year, which is no more than a guess tax, they might have to sell some of that property that acreage, or whatever, to pay the tax. It just doesn't make sense.”

Nelson says Washington would be better off concentrating on the taxes they aren’t collecting.