NCGA Pleased to See Treasury Embrace GREET Model

The U.S. Department of Treasury announced today that it will use a modified version of the GREET model as a measurement for determining reductions in greenhouse gas emissions as the agency allocates tax credits for sustainable aviation fuels under the recently passed Inflation Reduction Act.The National Corn Growers Association (NCGA) said it is pleased that Treasury is embracing the model.

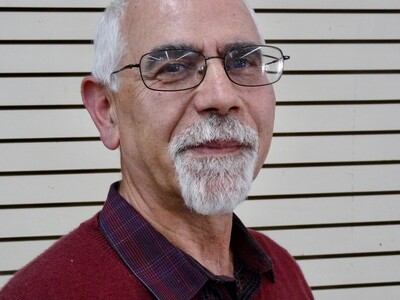

“Given that GREET was created by the U.S. government and is widely respected for its ability to measure reductions in greenhouse gas emissions from the farm to the plane, we are encouraged that Treasury will adopt some version of this model,” said Minnesota farmer and NCGA President Harold Wolle. “At the end of the day, we are eager to help the aviation sector lower its carbon footprint, and we look forward to working with the involved agencies over the coming months to ensure the final model helps us achieve that goal.”

The decision by Treasury Secretary Janet Yellen has been eagerly anticipated since the Inflation Reduction Act was passed in 2022. The law allocates tax credits for biofuels that can demonstrate that they cut greenhouse gas emissions by 50% or more.

GREET, which stands for the Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation, was developed by the U.S. Department of Energy to measure greenhouse emissions from the field to the car or plane.

Source: NCGA