Non-fundamentals take wheat futures higher

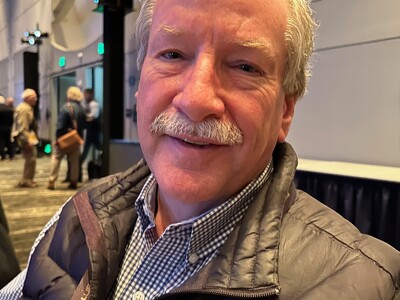

Market Line January 7, 2010 Wheat futures put in double digit gains Wednesday. Many traders have been looking for index fund buying to start this month and reports suggest the funds were buyers in wheat yesterday. Outside markets like higher crude oil and a lower dollar also provided support. Next week USDA will release its estimate of winter wheat plantings but private estimates are coming out. Farm Futures say soft white may show a small increase while hard red winter acres could be down nine percent with soft red down 30 percent. Allendale is looking for decreases in all winter wheat classes with total acreage the lowest in three years. On Wednesday Chicago March wheat was up 14 ¼ cents at 5-67 ¼. March corn up three cents at 4-21 ¾. Portland soft white wheat steady at mostly 5-05. New crop August soft white steady to higher at 4-85 to 5-20. Club wheat premium $3.25. New crop August HRW 11.5 % protein up 14 cents at 6-16 to 6-26. Last half January DNS 14% protein 16 cents higher at 7-07. No Portland barley bids. Cattle futures were lower Wednesday with profit taking cited as a factor. The winter weather in the Plains provided some support and had traders looking for at least steady cash fed prices this week. Feeder contracts were at a premium to the CME Feeder Index. Feb live cattle down 37 cents at 85-95. March feeders down 17 at 96-75. Milk futures for the year dropped an average of 11 cents with February Class III milk down 14 cents at 13-52. I’m Bob Hoff and that’s Market Line on the Northwest Ag Information Network. Now this.