More USDA reports this week

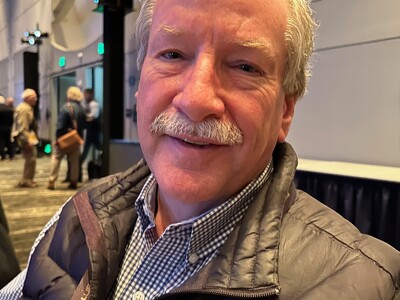

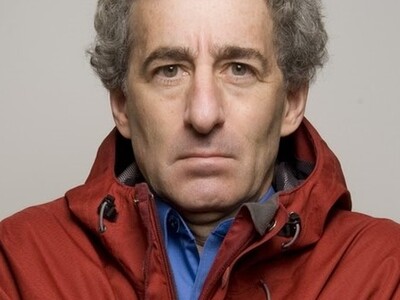

Market Line September 28, 2009 This Wednesday traders will get a Quarterly Grain Stocks and a Small Grains Summary report from the USDA. Traders will also be checking Australian weather regarding frost threats for wheat. Meanwhile back on Friday, wheat futures, which had a double digit up day Thursday, saw double digit losses. Much of the blame went to the uncertainty regarding what the Commodity Futures Trading Commission will do regulatory wise on the convergence issue for Chicago wheat contracts. Louise Gartner for the Linn Group at the Chicago Board of Trade says that reaction may not be over yet. Gartner: “Lot of adjusting to be done if indeed they are going to change the storage rate structure as much as they are talking about. Could be some bigger moves down the road, especially for the deferred contracts.” On Friday Chicago December wheat was down 23 ¼ cents at 4-49 ¾. December corn down 2 ½ cents at 3-34. Portland soft white wheat steady to 15 cents lower at mostly 4-35. Club wheat premium $3.25. HRW 11.5 % protein down 15 cents at 5-04. DNS 14% protein down 13 cents at 6-07. No Portland barley bids. Poor boxed beef prices and steady to lower cash fed cattle put pressure on cattle futures Friday and they closed lower. Traders are expected to watch the reaction today to USDA’s Quarterly Hogs and Pigs report issued Friday. The inventory was down two percent from September of last year with the breeding herd down three percent. In the futures Friday, December live cattle up seven cents at 85-35. November feeders down 55 at 96-72. November Class III milk up 18 cents at 13-54. I’m Bob Hoff and that’s Market Line on the Northwest Ag Information Network. Now this.