Cash Rents Lower, Ag Land Values Higher

Lorrie Boyer

Reporter

“Where we're seeing the farmers' assessed value of their agricultural real estate increasing by 4.3%.”

He cites the reason for the flattening of prices,

“As we went through, say, 2021, 2022, and even 2023 with very high commodity prices, we saw really strong growth in both cash rents and in land values.”

And how do low commodity prices factor in?

“I think we have a cooling, but the cooling is, interestingly, much more on the cash rent side, in terms of year-over-year growth, than it is on how producers view the value of their land.

Breaking down land values by cropland and pasture land,

“If we separated out into cropland. Still, producers assess that cropland increased 4.7% in 2025 to $5,830 an acre, So assessing that cropland is increasing at a greater rate than overall ag land and pasture land showing an even larger increase at 4.9%.”

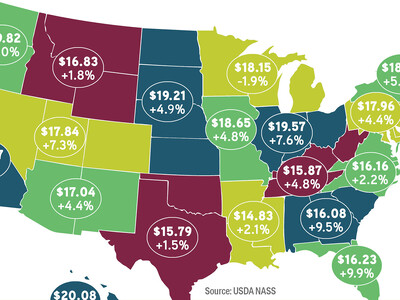

With all US states experiencing increases in farm real estate values, according to Meyer.