Farm Bankruptcies

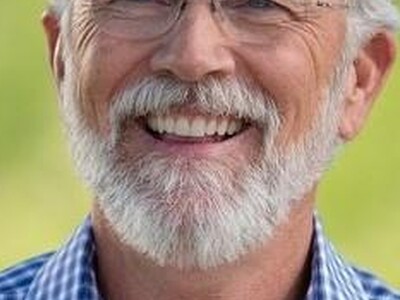

Following years of depressed prices and trade concerns, the number of farm bankruptcies is rising.Farm bankruptcies were rising before the coronavirus pandemic, and more challenges are ahead. American Farm Bureau Federation Economist John Newton says the trend is concerning.

"What we’ve seen is over the last 12 months ending March 2020 is Chapter 12 bankruptcies in the United States totaled 627 filings, that was up 23 percent. While it’s well below the levels we saw in the ’80s, it’s still the third-highest that we’ve seen in the last 20 years, so it’s a concerning trend," said Newton.

Newton says those bankruptcies occurred prior to the coronavirus pandemic, which has resulted in steep declines in commodity prices.

"We did see the administration roll out the Coronavirus Food Assistance Package with $16 billion in support to agriculture. But that’s just an initial down payment. Farmers are going to face struggles with high unemployment, loss of off-farm income, and farm debt at a record $425 billion, that could increase farm loan delinquencies," said Newton.

Newton says farmers will need additional relief.

"Farmers have an opportunity to go in and enroll for the CFAP funding after Memorial Day, that’s going to provide an immediate financial boost to some farmers across the country. We know that the Secretary has $14 billion in additional funding available later this summer. And, then I think as Senators start to work on the next assistance package, thinking about the needs of agriculture, to help us bridge the gap and avoid more farm bankruptcies in the future," concluded Newton.