Tax exemptions for ag a continuing issue

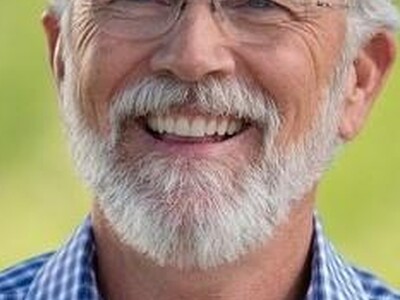

Washington Ag Today July 1, 2011 Washington state farmers and ranchers benefit from numerous state tax exemptions on inputs used in their operations and they did not lose any of those breaks during this year’s state budget balancing by lawmakers. That doesn’t mean the threat is over. Washington Association of Wheat Growers President Ben Barstow reviews what’s at stake and in the bulls eye. Barstow: “We don’t pay sales on fertilizers and pesticides for example, but those are two exemptions that have a big target on them right now. We are currently exempt from the B&O tax and that could go away as well. Both of those things are up for grabs sometime in, maybe not in this next legislative session but probably in the year after.” Barstow says it’s pretty simple to calculate the added cost farmers would face with the loss of a sales tax exemption. Barstow: “You know about how much you spent last year on fertilizers and pesticides. Add sales tax onto it. 8.6%. Eight-point-six percent cost increase on fertilizers and pesticides just like that, with the stroke of a pen.” If a B&O tax was enacted at a percent and a half and you add the sales tax, Barstow says his costs would increase about ten dollars an acre. Even if state lawmakers don’t eliminate tax exemptions the issue could become a ballot measure. I’m Bob Hoff and that’s Washington Ag Today on Northwest Aginfo Net. ? ? ?